It's perfectly legal for Congress members to profit from insider trading. Isn't that special.

It's perfectly legal for Congress members to profit from insider trading. Isn't that special.The Seattle Post-Intelligencer posts an opinion piece on that little loophole.

Despite laws like the Securities Act of 1933 and the Sarbanes-Oxley Act of 2002 that cracked down on insider trading for the rest of Americans, Congress left itself some wiggle room.

"Unfortunately, Congress forgot itself. It remains perfectly legal for a member of Congress to buy and sell stocks based on information that's not available to the public. Last year it was reported that a 'political intelligence' firm tipped off its clients to an undelivered speech by Senate Majority Leader Bill Frist on asbestos liability. The information was profitable to those in the know." -- Seattle Post-IntelligencerAnd they appear to take advantage of what they learn in hearings and talking to lobbyists.

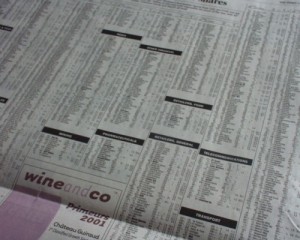

We told you on November 8, 2005, that US Senators outperform the stock market by 12%. And the "Midas touch" for the industry is considered around 3%. And the reason -- better access to inside information. (Seattle P-I)